U.S. Census Bureau publishes a series of aggregate statistics on the financial results and position of U.S. corporations under its Quarterly Financial Report (QFR) Program. Based upon a sample survey, the QFR presents estimated statements of income and retained earnings, balance sheets, and related financial and operating ratios for manufacturing corporations with assets of $250,000 and over, and corporations in mining, wholesale trade, retail trade, information, and professional and technical services (except legal services) industries, with assets of $50 million and over. The statistical data are classified by industry and by asset size.

The QFR data are used as an important component in determining corporate profits for the Gross Domestic Product (GDP) and National Income estimates. Additionally, the Federal Reserve, the Treasury, and the FTC use QFR data to assess such things as industrial debt structure, liquidity, tax liability, and profitability, and the Council of Economic Advisers and Congressional Committees utilize key indicators derived from QFR data as they design economic policies and draft legislation. The data have clear utility to business leaders and finance professionals as a financial benchmark and an indicator of the overall health of the private sector and specific manufacturing sectors, such as chemicals.

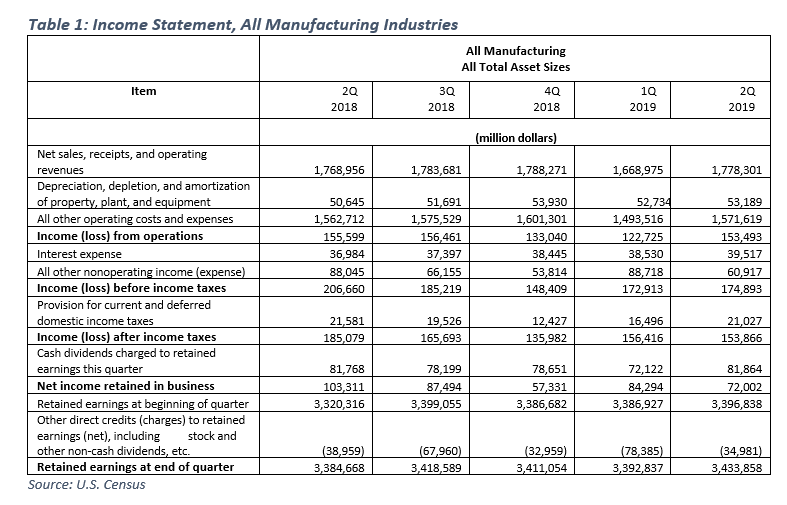

The QFR also provides income statements by various sectors1 and also provides various financial ratios of interest. Table 1 shows the overall income and expense status of all manufacturing industries over the past five quarters.

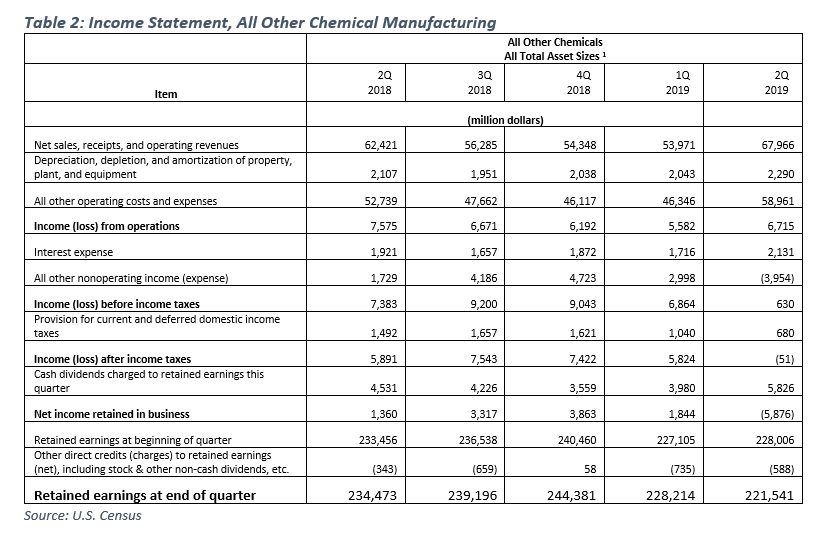

The Census also drills down to specific NAICS groupings within manufacturing and the other sectors. For example, within manufacturing, Census provides data on chemical manufacturing in general,2 along with “Basic Chemicals, Resins, and Synthetics”3, Pharmaceuticals, and “all other chemicals”4, which including paint and coatings manufacturing, NAICS 32551.

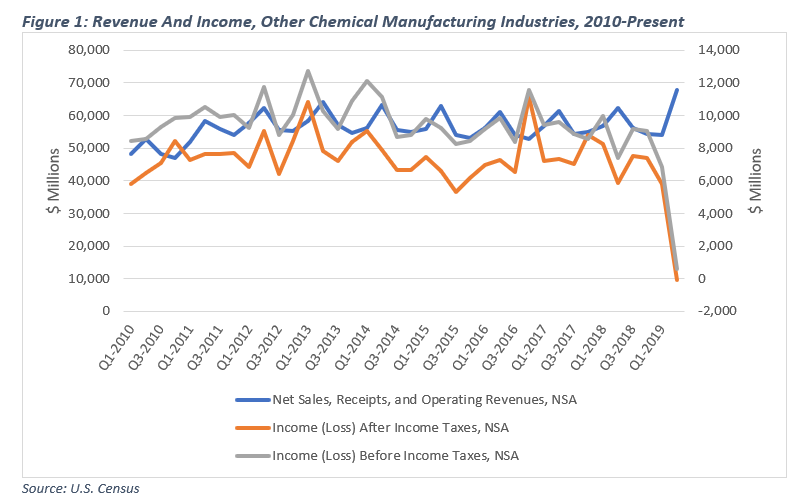

Looking more closely at the category “all other chemicals,” Figure 1 shows the overall aggregated revenues and expenses of the manufacturing sector “other chemicals,” where the coatings industry resides, along with pre and post-tax earnings. Although after-tax income for this grouping of industries has averaged approximately $7.5 billion per quarter from 2010 through Q1 2019, in the most recent quarter reported (Q2 2019), the sector had a loss of $51 million. As shown in Table 2, this appears to be largely the result of a roughly $7 billion swing in the accounting category “All other nonoperating income (expense).”

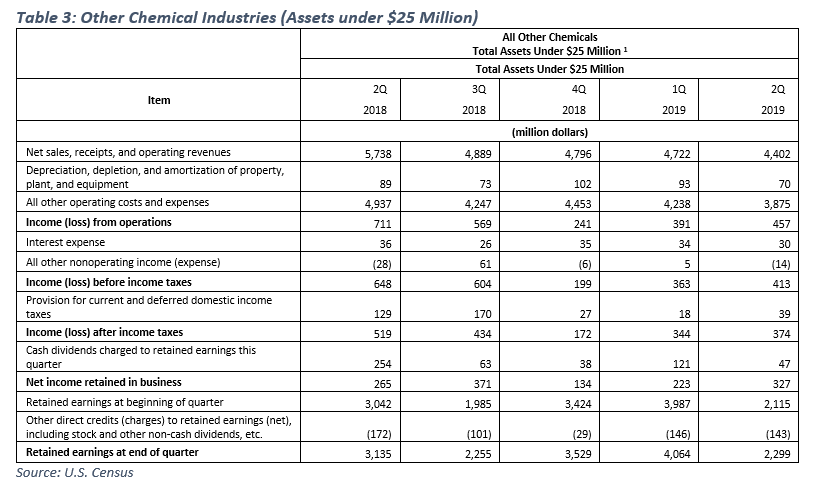

Census also provides a separate breakout for smaller firms (with total assets less than $25 million), which provides an interesting comparison. For example, in the most recent quarter, while the aggregated large firms in the category showed a net loss after taxes, the smaller firm category recorded a profit5 of 9.38% pre-tax and 8.5% post-tax.

For more information on the Quarterly Financial Reports program, including downloadable income and balance sheet calculations, go to https://www.census.gov/econ/qfr/.

For more information on the Quarterly Financial Reports program, including downloadable income and balance sheet calculations, go to https://www.census.gov/econ/qfr/.

Contact ACA’s Allen Irish for more information.

1 In addition to manufacturing corporations (with assets of at least $250,000), Census provides QFR data on corporations in mining, wholesale trade, retail trade, information, and professional and technical services (except legal services) industries, with assets of $50 million and over.

2 NAICS Manufacturing Industry Group 325.

3 NAICS Manufacturing Industry Groups 3251 and 3252.

4 NAICS Manufacturing Industry Groups 3253, 3255, 3256, and 3259. This grouping includes a variety of industries, including pesticides, fertilizer, soaps and detergents, and adhesives.

5 Calculated as income as a percentage of net sales, receipts, and operating revenues.

The post Census QFR Program Provides Insights into Industry Financial Status appeared first on American Coatings Association.

from American Coatings Association https://www.paint.org/qfr-census/

via IFTTT

No comments:

Post a Comment